CIN-CG & VIJESTI investigation about the Atlas Affair: Djukanovic’s first million: Knezevic was guarantor

Not only did Dusko Knezevic pay for enormous bills in luxurious hotels and cover Milo Djukanovic’s credit card debts, but he also carried out the most confidential bank transactions for Djukanovic and his family. Knezevic put down a deposit of one and a half million euros as cash collateral for a loan which Djukanovic took out in London in 2007. Through that loan the current Montenegrin president later legalised his first million. Both Djukanovic and the representatives of Montenegrin institutions hid the fact that the guarantee for that loan was obtained from Knezevic.

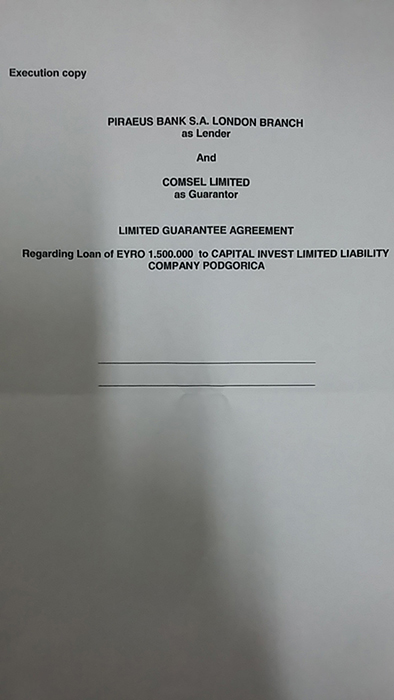

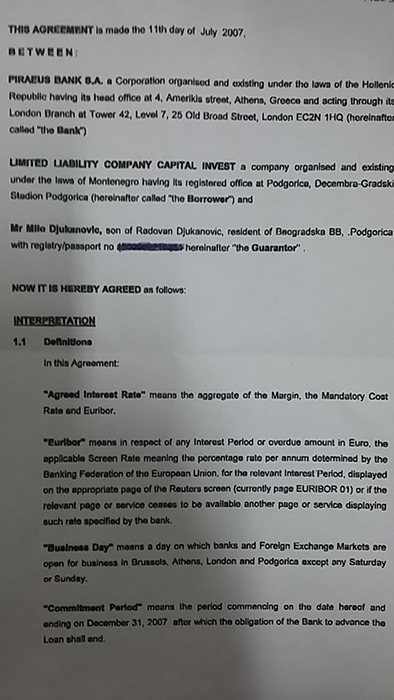

After he briefly left state office and decided to be involved in business, Djukanovic, on 11 July 2007 in the name of his company, Capital Invest, was granted a loan of one and a half million euros from the London branch of the Greek-based Piraeus Bank. His loan was enabled by Dusko Knezevic’s Cyprus-based company, Comsel Limited, which put down a cash deposit of one and a half million euros for that loan.

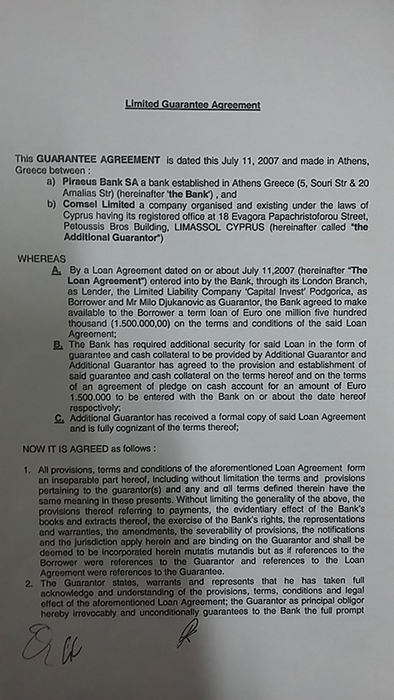

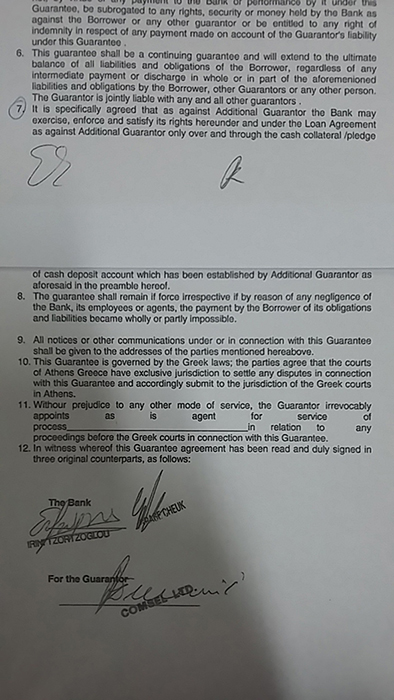

On that day, two contracts were signed in London. The first contract, regarding the guarantee of one and a half million euros for the loan to Capital Invest LTD Podgorica, was signed between Piraeus Bank SA, London branch, as the granter of the loan, and the company Comsel Limited from Cyprus, as the issuer of the guarantee.

From this contract of guarantee, which CIN-CG and “Vijesti” have had access to, it can be noticed that Milo Djukanovic, as the recipient of the loan, obtained the means for Capital Invest by the courtesy of Dusko Knezevic’s money. In the contract it is clearly detailed that the bank asked for an additional guarantee for the loan, and in the form of cash collateral. That was provided by the guarantor – Knezevic’s company Comsel Limited – which enabled this loan by depositing one and a half million euros with Piraeus Bank.

In the contract of guarantee signed by Dusko Knezevic and representatives of Piraeus Bank, it specifies that, in case Milo Djukanovic were not to pay back the loan, the bank has the right to recoup the funds exclusively through the cash collateral deposited by Knezevic’s company.

Djukanovic hid who had helped him

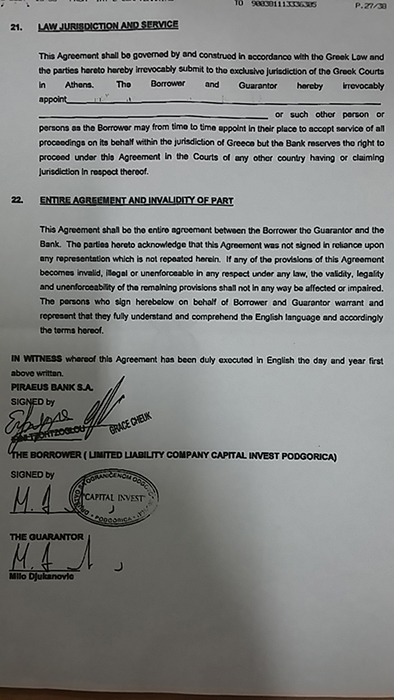

On the same day a second contract was also signed regarding a loan of €1.5 million between Piraeus Bank SA London as the creditor, Capital Invest DOO Podgorica as the beneficiary of the loan and Milo Djukanovic as the guarantor – the company’s owner. The usual provisions are detailed in the contract: conditions for repaying the loan, interest and others. It also states that Djukanovic should withdraw the loan until 31 December 2007. The contract was signed by Djukanovic, on behalf of Capital Invest, and in his name.

The story about this loan has appeared several times in public, but the details showing who Djukanovic’s guarantor actually was were hidden. The president himself kept this secret well and he even went as far as to deny that there was any deposit put down on his part. Instead he claimed that he was granted the loan because of his ethics, intergrity and reputation.

Later on' he didn't not want to reveal who his “friend” was who had deposited one and a half million euros for him, although in the media it was speculated that it was the same Dusko Knezevic, who had business ties to Piraeus Bank.

In answer to the question of where the property, with which he had guaranteed the loan, came from, he said: “During my state business I have made numerous acquaintances and it was no problem to obtain a loan with a foreign, respectable bank”. And it was no problem, since he had someone to put down millions in cash for him. Knezevic himself earlier said that he was not behind this arrangement.

He purchased shares in Prva Banka which began a dizzying rise

Djukanovic used this loan to buy, through recapitalisation, part of the shares in Prva Banka, whose biggest shareholder was his brother Aco. To remind you, the younger Djukanovic bought a small, Niksic-based local bank which was later renamed “Prva Banka Crne Gore (First Bank of Montenegro) established in 1901”. Courtesy of its privileged position in the market and large state deposits, the bank grew tenfold in a short time, to become today one of the most significant banks in the country.

On 3 August 2007, Milo Djukanovic obtained shares in Prva Banka at the privileged price of €127 each, via recapitalisation. On the same day on the stock market, Prva Banka’s shares were being traded for €188 each. Capital Invest spent the entire loan obtaining 11,657 shares, for which €1,489,997 was spent.

As soon as Milo Djukanovic joined his younger brother’s bank, the shares started a dizzying rise. In only 20 days the value of one share rose almost twofold, to €334. The bank was on the A-list of Montenegrin stocks and, according to the rules, its shares were not permitted to have a daily rise of more than 10 percent. The shares in Djukanovic’s brother’s bank exceeded this limit almost every day, and often only one share was traded each day, which points to the conclusion that room for a greater increase was being created by the trading of symbolic amounts.

Mitrovic concealed the wording of the contract

After Djukanovic attracted public attention to this million-euro transaction, since his monthly salary as a state official had been less than €1,000 for years, it was announced by the Administration for the Prevention of Money Laundering that Capital Invest had borrowed “from a bank in London” to fund the purchase of shares. The Administration, headed by Predrag Mitrovic, then announced that it could be seen from Djukanovic’s loan agreement signed on 11 July that the repayment of the loan was guaranteed by the shares bought in Prva Banka. Now it is clear that the Administration for the Prevention of Money Laundering wanted to hide the fact that Dusko Knezevic, or his Cyprus-based company Comsel Limited, had guaranteed for this loan.

Djukanovic’s loan was later marked top-secret by Mitrovic to prevent MANS getting hold of details about this arrangement, because this organisation had been seeking information about it for months under the Law on Free Access to Information. Even then it was clear that the shares in Prva Banka could not have been the collateral for the loan because they were only written into the Pledge Register three months later. Now it is clear from the documentation and contracts which we have had access to that Djukanovic first took out the loan courtesy of his friend Knezevic, and only then bought the shares in his brother’s bank. After public interest was raised regarding where Djukanovic got the money from, the collateral was registered in October 2007.

Mitrovic, the keeper of the secrets about the loan, is in the news lately. Dusko Knezevic claims that, after Mitrovic was shot in the leg, he had to “iron out” relations between the former director of the Administration for Prevention of Money Laundering and Djukanovic. Last week, Knezevic called on Djukanovic to explain to the public why Predrag Mitrovic had been shot in the leg.

Shares worth €7 million in 3 months

Djukanovic really hit it lucky with this loan. The shares in Prva Banka which he bought for one and a half million euros had a dizzying rise and after they were written into the Pledge Register in October 2007 they were already worth €6.9 million on the stock market.

A year after he took out the loan, Djukanovic paid off the debt with Piraeus Bank by selling a minor part of the shares in Prva Banka, 2,540 of them precisely, at the fantastic price of €610 each, for €1.55 million in total, the exact amount he needed to pay off the entire loan. “Vijesti” source earlier reported that an individual linked with Prva Banka had bought the shares from Djukanovic. “My first company Capital Invest had overseas debts, and those obligations had to be serviced. I sold on the stock market part of the shares which the company had and got rid of its debt,” Djukanovic then clarified.

What is interesting is that, a few days after Djukanovic sold part of the shares in Prva Banka for one and a half million euros, their rise on the stock market stopped. And when the bank was in crisis in 2009 and the Central Bank of Montenegro (CBCG) had to take measures, the shares significantly dropped. Even some friends of the Djukanovic family sold their shares in Prva Banka in order to save their money.

Growth of roughly €1 million even after Prva Banka was bailed out

Up until 2013, Djukanovic retained ownership of the bank, which the government in the meantime had to save because of risky business practices in 2010 with an injection of €44 million. In April 2013 the current Montenegrin president formally came out of ownership of Prva Banka. At that time he sold 10,466 shares at the price of €102 each. He thereby earned his first legal million, because with the previous sale he had paid off the loan. In this case too, when the president sold the shares, they were at a good price. Only four days earlier one share in Prva Banka had been worth €76, but after three days’ rise it reached the price at which the current president received a million euros in return for his package of shares.

After this transaction, Djukanovic’s company deposited one million euros in Prva Banka. Since then he has received about €50,000 in interest, which was the only income of this company. According to the report of Prva Banka’s auditors, on 31 December 2017 Capital Invest had deposits of €1.15 million in that bank.

In May of last year, when Djukanovic again returned to state function after a short break, he transferred Capital Invest to his son Blazo.

Goran KAPOR and Milka TADIĆ-MIJOVIĆ