INSUFFICIENT EU AND NATO INVESTMENTS: Foreign Capital Favors Real Estate Over Development

Investors from Serbia, Russia, and Turkey were the leading contributors to Montenegro's investment landscape last year. However, the profiles of these countries do not align with Montenegro's Euro-Atlantic aspirations. Many foreign investors have expressed dissatisfaction with the investment climate, while the Government lacks a clear strategy to address these concerns.

Predrag Nikolić/Đurđa Radulović

In the past year, Serbia, Russia, and Turkey were the leading foreign investors in Montenegro, accounting for over a third of the total foreign direct investments (FDI) in 2024. These three countries collectively invested approximately 318 million euros out of 889 million euros in FDI. In contrast, investments from the European Union (EU) countries were significantly lower, totaling only 250.5 million euros.

"The depth of the integration process is not reflected in the shift of investor profiles, as EU countries do not dominate the top of the list. This statistic reveals significant gaps that warrant further investigation," Gordana Đurović, a full professor at the Faculty of Economics and former Minister for European Integration, says in an interview with the Center for Investigative Journalism of Montenegro (CIN-CG).

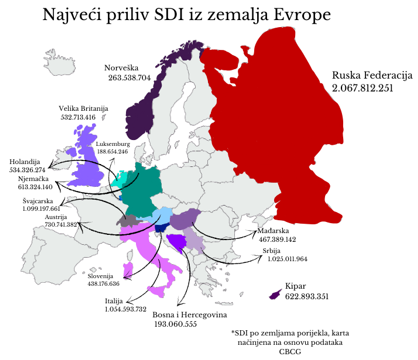

The trend of investments from countries outside the Western bloc continued even after Montenegro regained independence in 2006 and declared EU and NATO membership as key priorities. Since then, Montenegro has received over 14.6 billion euros in foreign direct investments (FDI). Of this total, ten countries accounted for approximately nine billion euros in assets. Among them, only four are members of both the EU and NATO, along with Turkey, which is part of the NATO alliance.

FDI by Country of Origin, Table Based on CBCG Data

Italy, Austria, Cyprus, and Germany are among the top ten foreign investors from EU countries, with their total investments exceeding three billion euros.

Russia leads in foreign direct investment (FDI) with over two billion euros invested, maintaining a position in the top five investors every year since Montenegro's independence. Following Russia are Switzerland, Italy, and Serbia, each contributing slightly more than one billion euros. The top ten also includes Turkey, along with the United Arab Emirates (UAE) and Azerbaijan, each investing over half a billion euros.

Since 2006, investments from EU countries account for less than half of the total FDI, totaling 6.1 billion euros.

In a statement to CIN-CG, the office of Prime Minister Milojko Spajić highlighted some of Montenegro's most significant projects, such as the submarine energy cable between Montenegro and Italy, implemented by the Italian company Terna. They also pointed out that many representative offices of foreign companies based in Serbia indirectly contribute to investments in Montenegro.

Furthermore, they assert that, in line with Montenegro's EU accession process, a greater influx of investments from Western European countries is expected.

"Due to global developments in recent years, there has been a decline in interest from Russian investors, while interest from the EU and other countries has increased. Therefore, we disagree with the statement that developed EU countries are not investing in Montenegro," the Prime Minister's office states.

However, data from the previous year, based on statistics from the Central Bank of Montenegro (CBCG), contradicts these claims. Serbia, Russia, and Turkey remain the leading foreign direct investors.

Tax Havens: A Major Source of Foreign Capital in Montenegro

Since its independence, the top 20 most prominent investors in Montenegro include tax havens, such as the Virgin Islands, with 184 million euros, and Panama, with 173 million euros. When investments from other similar destinations—like Barbados, the Bahamas, Belize, Jersey, Mauritius, Seychelles, Gibraltar, Bahrain, the Cayman Islands, and the Marshall Islands—are included, the total exceeds 600 million euros. This amount alone surpasses the total investments from Germany, one of the largest EU investors, since Montenegro's independence.

In reality, investments from non-transparent regions are likely even higher. Offshore companies based in countries like Cyprus, the UK, the Netherlands, and others are not reflected in these figures, as there is no available data to differentiate between investments from offshore companies and those from entities with transparent ownership structures.

"Investment through offshore companies may suggest an attempt to conceal the true owner or the origin of the capital," Zarija Pejović, an economic analyst, says in an interview with CIN-CG. "Domestic capital can also set up a company in a tax haven and then establish a subsidiary in Montenegro, benefiting from lower tax rates at the parent company level. In such cases, the oversight of the Tax Administration is crucial."

There has generally been a lack of oversight regarding the influx of substantial capital into Montenegro. The investments made by hidden owners have had a greater impact on the personal enrichment of individuals than on the overall well-being of society and its citizens. Investing through offshore companies was frequently utilized by Montenegrin nationals to conceal the origins of suspiciously acquired capital and subsequently legalize it within the country.

The Pandora Papers, a global investigation into offshore financial activities, was conducted by the International Consortium of Investigative Journalists (ICIJ) in collaboration with partners from 117 countries. The leaked database includes nearly 12 million documents sourced from registries in jurisdictions such as the British Virgin Islands, Panama, Belize, Cyprus, the United Arab Emirates, Singapore, the United Kingdom, Switzerland, and others.

This 2021 affair has yet to reach a judicial conclusion in Montenegro. The Panama Papers reveal that former Prime Minister and President Milo Đukanović and his son Blažo were involved in secret asset management agreements in 2012, concealing their assets through a network of companies registered in the United Kingdom, Switzerland, the British Virgin Islands, Panama, and Gibraltar.

Lack of Investment in Montenegro's Development

The issue goes beyond the source of the money. Gordana Đurović emphasizes that, in terms of structure, the investments fail to demonstrate a focus on active engagement in the real sector, which is critical for the country's development. This presents a significant challenge, as Montenegro has relied almost entirely on foreign direct investment (FDI) for its growth and development since gaining independence. "The net inflow of FDI has averaged about 14 percent of GDP annually, highlighting a development model that is largely based on attracting FDI, without a strong export orientation, particularly in terms of commodity exports," Professor Đurović explains to CIN-CG.

However, despite foreign direct investment (FDI) since independence approaching 15 billion euros, with nearly 10 billion euros in net FDI, these funds have been insufficiently utilized for the country's development, Đurović explains.

FDI Structure, Table Based on CBCG Data

The structure of investments since Montenegro's independence reveals that the largest share of capital went into real estate (32.9%), followed by investments in the real sector (31.6%). In comparison, 30.6% of foreign direct investment (FDI) went into intercompany debt—essentially loans from parent companies to their subsidiaries in Montenegro. These loans do not contribute to increasing the basic capital of the local companies.

Zarija Pejović explains that the high share of intercompany debt (30.6%) suggests that parent companies prefer lending to their subsidiaries in Montenegro instead of recapitalizing them. This strategy allows them to reduce taxable profits by deducting interest rate expenses, thus lowering their tax liabilities in Montenegro.

According to CIN-CG sources, investments in real estate accounted for over half of the total FDI in 2023 and 2024, a worrying trend considering Montenegro's failure to diversify its economic sectors and encourage exports. "Healthier investments, such as those from Serbia, contribute to the real sector, which supports the country's development. In contrast, Russian investments predominantly flow into real estate, which stifles development," Đurović says.

Pejović adds, "The impact of real estate investments on economic growth is primarily seen in increased consumption. This drives up property prices, making it harder for the local population to afford homes for basic needs."

However, the Prime Minister's office argues that real estate investments can benefit society. "They don't necessarily hurt the economy, especially through growth in the construction sector, increased tourism, business, and housing capacities, and the rise in consumption linked to property purchases—investments that typically offer quicker returns than those in the real sector." They also highlight that such investments contribute to employment, strengthen supporting activities, and increase budget revenues through taxes and fees. "Moreover, this type of investment, particularly through the economic citizenship program, has accelerated the development of northern municipalities, especially Kolašin," the Prime Minister's office stated in an interview with CIN-CG.

However, several experts, architects, and urban planners have warned that the rapid urbanization of Kolašin, driven in part by the economic citizenship program, has led to the city's degradation and the destruction of surrounding areas. This phenomenon of accelerated urbanization has similarly impacted other valuable regions in Montenegro.

Investments in Companies Decline Since the COVID-19 Crisis

Foreign direct investment (FDI) has significantly declined over the past two years, following the increases in 2021 and 2022. The drop in investment, particularly in companies and banks, is especially notable. In both 2022 and 2023, investments in domestic companies were lower than in 2020, the year of the COVID-19 crisis, when they totaled 123 million euros. When accounting for inflation since 2020, the figures become even more concerning. In 2020, investments amounted to 123.8 million euros, rising to 215 million in 2021 and 219.4 million in 2022. However, in 2023, there was a dramatic decline, with only 95.2 million euros invested from abroad. While the situation slightly improved in 2024, investments in companies only reached 113.9 million euros, almost half of what was invested in 2023.

Despite the sharp decline in company investments, CBCG data shows that real estate investments have remained steady, averaging around 450 million euros annually over the past three years.

FDI Structure (2020-2024), Based on CBCG Data

"Analysis of FDI inflows into Montenegro reveals a downward trend in recent periods, accompanied by shifts in the structure of investments. Specifically, there has been a decline in investments in companies and banks, while the real estate sector has seen an increase. This shift indicates a weakening of Montenegro's investment attractiveness, further exacerbated by political instability in the country, according to the 2024 White Book by the Montenegrin Foreign Investors Council.

The trend of rising investments was particularly notable in the post-pandemic period and following Russia's aggression against Ukraine. In 2021, the first year of the invasion, FDI surged, nearing the one billion euro mark, and in 2022, it surpassed one billion. However, in 2023 and 2024, FDI dropped below 900 million euros.

"Montenegro needs more investments in companies and fewer in real estate, as only such investments can have a sustainable and measurable impact on the development of local communities and the country as a whole," Gordana Đurović notes.

According to data from various sources, approximately 100,000 foreign citizens have temporarily settled in Montenegro. However, as highlighted by CIN-CG sources, this influx has not led to significant investments in the real sector or the creation of new jobs.

Research by BIRN in 2023 revealed that 64% of the nearly 6,000 companies established in Montenegro by Russian citizens following the invasion of Ukraine have only one employee, while over 20% have no registered employees beyond the founder. In the first year of Russia's aggression against Ukraine, these companies contributed just 4.8 million euros to Montenegro's budget, according to BIRN's findings.

Government's Absence of a Clear Strategic Vision

Spajić's cabinet informed CIN-CG that the Government's priority is to direct investments, particularly foreign ones, into the real sector of Montenegro's economy. However, according to Gordana Đurović, the investment community perceives Montenegro, like other Western Balkan countries, as lacking sufficient security for private property and investments. She adds that the absence of effective control over foreign investors, slow responses to poor business practices, breaches of contracts, and violations of investment deadlines all work against the state's interests.

"The potential for foreign investment in Montenegro, and its potential for economic development and diversification, is unquestionable. However, to fully realize this potential, it is necessary to ensure a predictable and transparent business environment," the Foreign Investors Council in Montenegro stated. They emphasized that strengthening the rule of law is essential for creating a predictable and stimulating investment climate. Despite highlighting this need for years, they noted that the situation has yet to improve.

On the other hand, the Government pointed out to CIN-CG that Montenegro is actively strengthening economic stability, creating new jobs, and boosting competitiveness. They claim to address challenges such as the availability of skilled labor, infrastructure development, environmental protection, and restitution, which have caused delays in investments in the real sector. Furthermore, they are focused on improving the legislative framework to enhance the investment climate.

However, the Foreign Investors Council in Montenegro believes that despite some post-pandemic progress, the fundamental issues persist, as detailed in their 2024 White Book. "The Government's reform efforts are insufficient to address the serious challenges threatening the sustainability of Montenegro's economy," the publication states. It also points out that the GDP growth the Government promotes is largely driven by increases in wages and pensions, rather than a boost in productivity from production and investment, which undermines long-term development. They further assert that the stabilization of public finances is mainly due to foreign spending rather than genuine structural reforms. The increase in minimum wages, they argue, is also questionable as it is not tied to growth in the real sector.

The White Book highlights several alarming issues: the economy's dependence on consumption, an alarming trade deficit of 14%, a lack of exports, inflation surpassing the EU average in 2022 and 2023, which has hindered the survival of small and medium-sized enterprises, especially in underdeveloped regions, and an oversized public sector, which remains the country's largest employer. It also stresses the lack of economic diversification and the over-reliance on tourism.

The publication also includes recommendations for urgent action: developing agriculture, processing industries, and technological sectors; reducing excessive employment in the public sector; supporting small and medium-sized enterprises, particularly in underdeveloped regions like the north; and fostering an environment conducive to productive FDI.

Should these recommendations be implemented, the structure of FDI in Montenegro could shift significantly, favoring the real sector and contributing to more sustainable economic conditions in the country.